If you have questions, we have answers.

Below you can find a listing of questions we commonly see customers ask. Please take some time to review the issues below as we think you just might find an answer to the question that brought you here!

Frequently Asked Questions

Click on each question frequently asked question below to reveal the answer. Don’t see your question asked? Visit the Contact Us page and submit your question online.

WHAT IS A 4506-C?

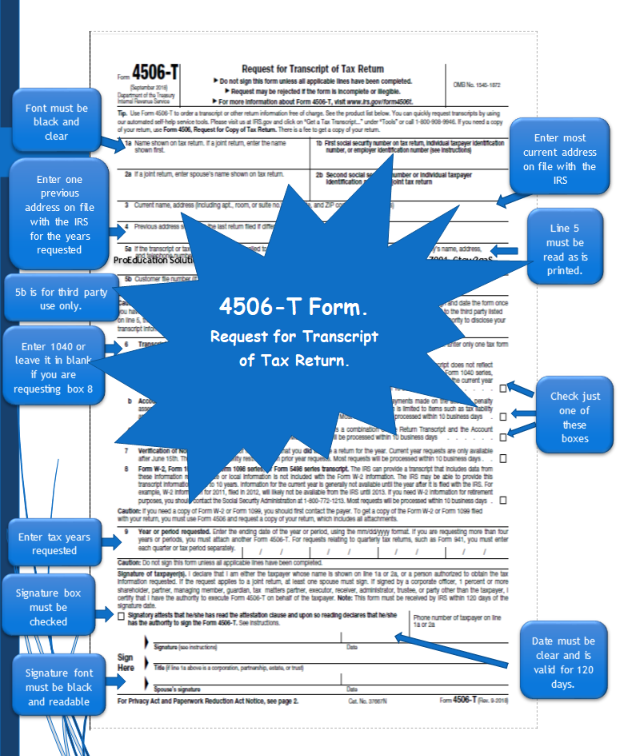

The IRS Form 4506-C is the form that must be completed to request a transcript (summary) of your tax return or other tax documentation from the IRS. The IRS processes the request and then returns a transcript to TaxDox electronically. Transcripts from the IRS can be used to apply for loans, student financial aid, or otherwise provide income verification.

In order for this form to be processed, it must have certain information. It needs the personal information of the person who is requesting the copy of tax return information in order to verify their identity. It also needs information about what type of tax transcript is requested and what tax year the tax information is from.

In order for this form to be processed, it must have certain information. It needs the personal information of the person who is requesting the copy of tax return information in order to verify their identity. It also needs information about what type of tax transcript is requested and what tax year the tax information is from.

HOW CAN I COMPLETE A 4506 T? (STEP BY STEP)

Once you complete payment checkout in TaxDox, you will be directed to an eSign IRS Form 4506-C Request for Transcript. To complete the 4506-C, you will need to following information:

- Taxpayer Name (as reported on the original tax return)

- Taxpayer Social Security Number

- Taxpayer Address- Use the address where the taxpayer lived when the return was originally filed to avoid rejects.

- Year or period for which you’re requesting the transcript, eg. 12/31/2018, 12/31/2017, 12/31/2016, etc.

- Signature

- Phone Number

WHY DID THE IRS REJECT MY REQUEST?

| IRS Reject Codes: | Description: |

|---|---|

| 1 - Problem with taxpayer/business name or SSN/EEIN | Taxpayer name and/or SSN is altered, illegible, missing, incomplete, or invalid; Business name and/or EIN is altered, illegible, missing, incomplete, or invalid. |

| 2 - Problem with taxpayer address | Altered, illegible, missing, incomplete, invalid, or two addresses present on line 3 and/or line 4. |

| 3 - Problem with Line 5 | Some or all of the following information is altered, illegible, missing, incomplete, or appears to be a label: Name (often business name) or two business names listed without DBA or C/O, Address, Participant ID Number, Batch ID or Individual ID, 2 addresses listed |

| 4 - Problem with SOR/Mailbox | Altered, illegible, missing, incomplete, or invalid |

| 5 - Problem with product requested | Line 6 is altered, illegible, missing, incomplete, or invalid; Box 6a, 6b, 6c, 8 is blank; Box 7 is checked; Line 9 is altered illegible, missing, incomplete, or invalid; POA documentation does not authorize forms, products or years requested. |

| 6 - Problem with signature/title | Altered, illegible, missing, incomplete, or invalid; Business title for signing person is not present or valid. |

| 7 - Problem with signature date | Altered, illegible, missing, incomplete; Expired or postdated |

| 8 - Illegible information on form | Information on form is illegible |

| 9 - Altered information on form | 10 - Information on form is altered |

HOW CAN I RETRIEVE MY RECORD OF ACCOUNT?

In less than a few minutes, you can be on your way to obtaining a copy of your Record of Account Transcript. All you need to do is create an account and login. Once you have completed the payment checkout process, we will guide you through filling out an IRS Form 4506-C Request for Transcript. Once that’s completed, we'll handle the rest. In a few short days, we'll notify you that your order has been completed!

TaxDox gives you the power to retrieve your tax documents through an easy and streamlined process. Save yourself the

headache and partner with us for an easy, affordable, and efficient way to get the tax documents you need!